Quantitative Finance MS and PhD

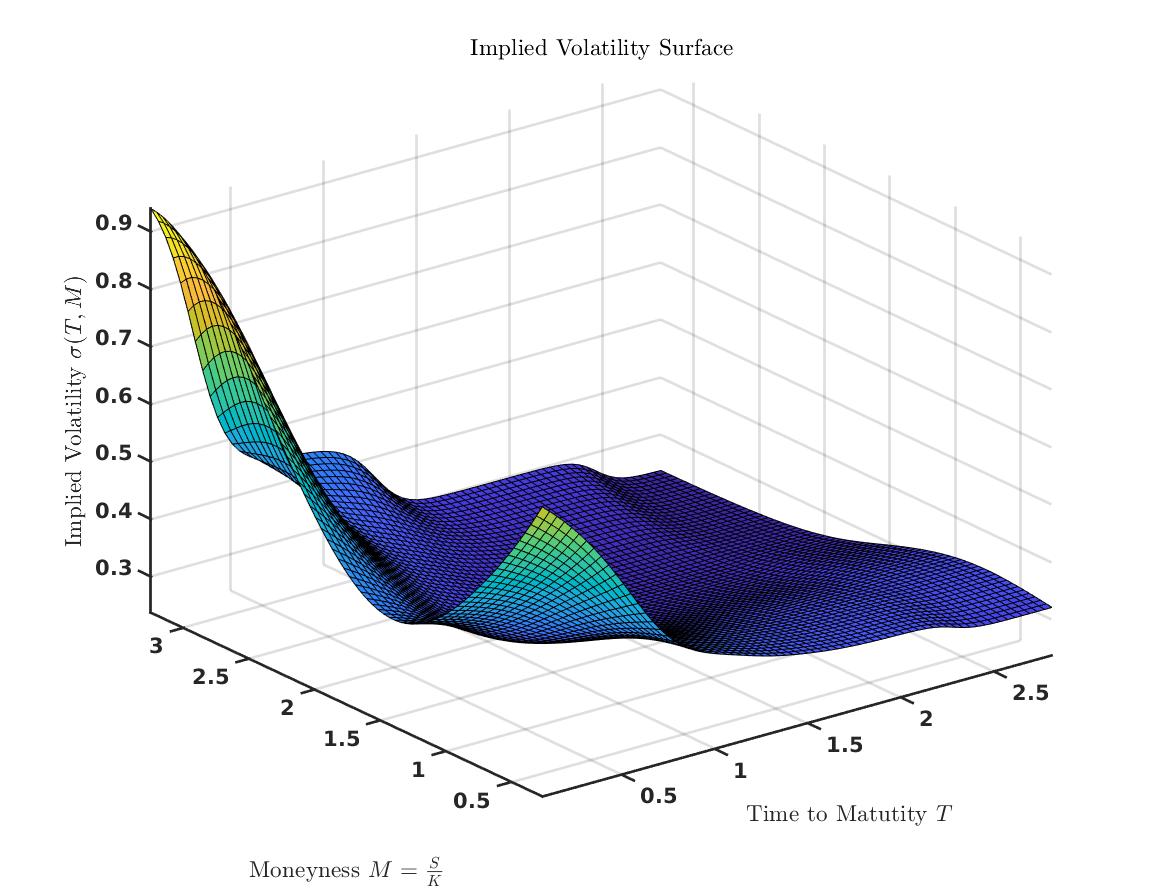

Figure: Implied Volatility Surface

SPECIAL QUALITIES OF STONY BROOK QUANTITATIVE FINANCE PROGRAM

Most of the Applied Mathematics faculty teaching quantitative finance courses have

extensive experience building quantitative trading systems on Wall Street. Because

of their Wall Street backgrounds, our faculty are able to place many of their QF students

in internships during the summer and the academic year at hedge funds and major investment companies.

Few other QF programs offer internships. There is limited use of adjunct faculty who

come to campus one or two evenings a week after work.

Figure: Merger Arbitrage Strategy

In the world of finance, the name 'Stony Brook' is famous for Renaissance Technologies, which is located a mile from the Stony Brook campus and headed by the former chairman of the Stony Brook Mathematics Department. Renaissance's flagship Medallion Fund has been the best performing hedge fund in the world for the past 20 years. One of the key creative minds at Renaissance, Robert Frey, Stony Brook Applied Mathematics PhD 1986, returned to Stony Brook in 2005 after early retirement at Renaissance to develop a Quantitative Finance program in the Stony Brook Applied Mathematics Department. Frey is chairman of the advisory committee to the University of Chicago's mathematical finance program, the country's best-ranked program in this area.

The Stony Brook Quantitative Finance program is unique among mathematical sciences departments in its very practical focus on 'alpha generation', Wall Street term for trading strategies for making money. Courses are centered on projects where students use real tick data to analyze and predict the performance of individual stocks and commodities, market indices and derivatives. Also, Stony Brook is one of a small number of quantitative finance programs offering PhD as well as MS training. Our PhDs have taken positions both in Wall Street firms and in university quantitative finance programs. For more information about our quantitative finance courses and faculty, see QF Courses and QF People.

Figure: New York Stock Exchange

Course Requirements for the Quantitative Finance Track

The standard program of study for the M.S. degree specializing in quantitative finance consists of:

AMS 507 Introduction to Probability

AMS 510 Analytical Methods for Applied Mathematics and Statistics

AMS 511 Foundations of Quantitative Finance

AMS 512 Portfolio Theory

AMS 513 Financial Derivatives and Stochastic Calculus

AMS 514 Computational Finance

AMS 516 Statistical Methods in Finance

AMS 517 Quantitative Risk Management

AMS 518 Advanced Stochastic Models, Risk Assessment, and Portfolio Optimization

AMS 572 Data Analysis

Quantitative Finance Track Electives (students must take at least 2 elective courses to achieve at least 36 graduate credits along with the required courses):

AMS 515 Case Studies in Machine Learning and Finance

AMS 520 Machine Learning in Quantitative Finance

AMS 522 Bayesian Methods in Finance

AMS 523 Mathematics of High Frequency Finance

AMS 526 Numerical Analysis I

AMS 527 Numerical Analysis II

AMS 528 Numerical Analysis III

AMS 530 Principles of Parallel Computing

AMS 540 Linear Programming

AMS 542 Analysis of Algorithms

AMS 550 Stochastic Models

AMS 553 Simulation and Modeling

AMS 560 Big Data Systems, Algorithms and Networks

AMS 561 Introduction to Computational and Data Science

AMS 562 Introduction to Scientific Programming in C++

AMS 569 Probability Theory I

AMS 570 Introduction to Mathematical Statistics

AMS 578 Regression Theory

AMS 580 Statistical Learning

AMS 586 Time Series

AMS 595 Fundamentals of Computing

AMS 603 Risk Measures for Finance and Data Analysis

Elective courses in the QF program are split in five focus areas. Students can follow one of the following course sequences depending upon their interests.

(A) Typical course sequence: Modelling and risk management in finance

- First Semester - AMS 507, 510, 511, 572 ( or Electives: AMS 520 for those who have already taken an equivalent data analysis course before and have experience with Python)

- Second Semester - AMS 512, 513, 517 (Electives: AMS 515, 522, 523, 603)

- Third Semester - AMS 514, 516, 518 (Electives: AMS 553)

(B) Typical course sequence: Machine learning and big data

- First Semester - AMS 507, 510, 511, 572(or Elective AMS 520 for those who have already taken an equivalent data analysis course before and have experience with Python)

- Second Semester - AMS 512, 513, 517 (Electives: AMS 515, 560, 580)

- Third Semester - AMS 514, 516, 518 (Electives: AMS 586)

(C) Typical course sequence: Statistics and data analytics

- First Semester - AMS 507, 510, 511, 572(or Elective AMS 520 for those who have already taken an equivalent data analysis course before and have experience with Python)

- Second Semester - AMS 512, 513, 517 (Electives: AMS 515, 570, 578 (with pre-requisite 572 )

- Third Semester - AMS 514, 516, 518 (Electives: AMS 553, 586)

(D) Typical course sequence: Stochastic calculus, optimization, and operation research

- First Semester - AMS 507, 510, 511, 572(or Elective AMS 520 for those who have already taken an equivalent data analysis course before and have experience with Python)

- Second Semester - AMS 512, 513, 517 (Electives: AMS 515, 542, 550, 569)

- Third Semester - AMS 514, 516, 518 (Electives: AMS 540, 553)

(E) Typical course sequence: Computational methods and algorithms

- First Semester - AMS 507, 510, 511, 572(or Elective AMS 520 for those who have already taken an equivalent data analysis course before and have experience with Python)

- Second Semester - AMS 512, 513, 517 (Electives: AMS 515, 526, 528, 561)

- Third Semester - AMS 514, 516, 518 (Electives: AMS 530, 562, 527 (co-requisite or pre-requisite 595 or 561)

Note 1: If you have poor programming skills take the following electives (instead of electives

recommended in sequences): AMS 595 Fundamentals of computing (Fall semester) or AMS 561 Introduction to computational and data science (Spring semester). Programming skills

are critically important for industrial jobs.

Note 2: If a 4th semester becomes necessary, a required course will be needed to continue.

For Ph.D. requirements please click here.

Quantitative Finance Opportunities for Applied Mathematics Graduate Students in Other

Tracks

Any strong student (3.5+ GPA in first-semester core courses) in another track may

enroll in AMS 511, Foundations in Quantitative Finance. Selected students, with the permission of

the Director of the Center for Quantitative Finance, may take additional quantitative

finance courses. Students are eligible to earn an Advanced Certificate in Quantitative Finance. You must formally apply for the secondary certificate program prior to taking the

required courses. Only a maximum of six credits taken prior to enrolling in the certificate

program may be used towards the requirements. The 15-credit advanced certificate

requires AMS 511, AMS 512, AMS 513, one additional Quantitative Finance Graduate course elective, and one additional Applied Mathematics course chosen with an advisor’s

approval.

To apply, download the registration form, please click here.